what is paypal ?

PayPal is a digital payment platform that allows users to make secure online transactions. It was founded in December 1998 by a group of entrepreneurs including Max Levchin, Peter Thiel, and Elon Musk. Initially, it was created as a way to securely transfer money between devices like Palm Pilots and Blackberrys, but it quickly grew into one of the most popular payment platforms in the world. Today, PayPal is used by over 300 million users worldwide, and it is accepted by millions of merchants both online and offline.

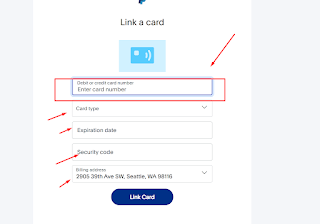

One of the biggest advantages of PayPal is its ease of use. Creating an account is simple and straightforward, and the platform is designed to be user-friendly. Users can link their PayPal account to their bank account, credit card, or debit card, and then use PayPal to make purchases or send money to other users. The platform supports a wide range of currencies, so users can send and receive payments in the currency of their choice.

PayPal also offers a number of additional features that make it more than just a payment platform. For example, users can set up recurring payments, so they can automatically pay bills or subscription fees on a regular basis. They can also use PayPal to create and send invoices, which is particularly useful for small business owners or freelancers who need to bill clients. And for those who want to do more with their money, PayPal offers investment options, such as a Money Market Fund and a Cash Reserve Fund.

One of the reasons PayPal has become so popular is its security features. The platform uses encryption and other security measures to protect users' financial information, and it offers a Buyer Protection policy that helps protect users against fraud and unauthorized transactions. If a user has an issue with a transaction, they can file a dispute with PayPal, and the platform will investigate and work to resolve the issue.

Another advantage of PayPal is its flexibility. Users can use the platform to make purchases from a wide range of merchants, including small businesses and independent sellers on platforms like Etsy and eBay. PayPal is also accepted by many online retailers, such as Amazon and Walmart, and it can be used to pay for services like Uber and Airbnb. In addition, users can transfer money between PayPal accounts, so it's easy to send money to friends and family members.

While PayPal is generally easy to use and secure, there are some drawbacks to the platform. One of the biggest issues is the fees that are charged for certain transactions. For example, users who receive payments for goods or services may be charged a fee of 2.9% plus $0.30 per transaction. This can add up quickly, especially for small business owners who rely on PayPal for their income. In addition, PayPal has been criticized for its customer service, which can be slow and unresponsive at times.

Another issue with PayPal is that it can be subject to fraud and scams. Hackers and scammers have found ways to exploit the platform, and some users have reported unauthorized transactions or other fraudulent activity on their accounts. While PayPal does offer some protection against fraud, it's important for users to be vigilant and take steps to protect their accounts, such as using strong passwords and monitoring their transactions regularly.

Despite these drawbacks, PayPal remains one of the most popular payment platforms in the world. Its ease of use, security features, and flexibility make it a convenient option for online transactions. And while there are some fees and risks associated with using PayPal, many users find that the benefits outweigh the drawbacks.

Overall, PayPal is a powerful tool for anyone who needs to send or receive money online. Whether you're a small business owner, a freelancer, or just someone who wants to make online purchases, PayPal offers a simple and secure way to handle transactions. And with millions of users around the world, it's clear that PayPal will continue